Author: Gianni Catalfamo

In recent times, two big corporate scandals seemed poised to shake the foundations of giant Corporations: Dieselgate and Cambridge Analytica. Who expected the two companies to sink, might be disappointed: data show record sales for Volkswagen and increased use of Facebook.

This is due – in my humble opinion – to our difficulty in focusing on anything that’s not short term: expecting that a segment so important for the economy flips instantly is like expecting a supertanker to turn on a dime.

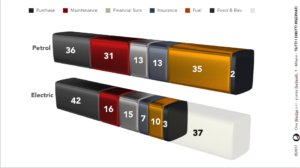

In the following chart I estimated the value of the Automotive segment for Italy (in billion Euros per year) concluding that the shift to electric mobility will probably cause 37 out of 150 bn to simply disappear but also re-allocating about 30 of the remainder.

67 billions changing hands (either in the pockets of consumers or move from one segment to another) in Italy alone which represents about 2.4% of the world market will require A LOT OF TIME to happen.

To be honest I do not know what is the corresponding earthquake impending on Facebook, but I would not expect it to happen in a month or in a year: the U.S Census Bureau tells us that the share of e-Commerce on total Retail sales was 0.5% in Q4 ’99, 3.8% in Q4 ’07 and was 10,.5% in Q4 ’17 – a little over 10% and we’re already yelling Armageddon.

My dad worked in the oil business and told me a few stories about oil tankers: in one he said that good skippers start to steer them before they even see the harbor. In another he said once the steering starts, nothing on Earth can stop it.